Kyrsten Sinema and the Password for Corporate Tax Cuts

If you say ‘small business’ enough, you can do anything.

In a video released earlier this month, Arizona senator Kyrsten Sinema announced that she would not run for reelection because, she lamented, she is too bipartisan for the American people, who would rather “retreat farther to their partisan corners.”1

A list of bipartisan accomplishments included in the video omitted a few highlights, such as Sinema’s enthusiastic thumbs-down vote to help stop an increase of the federal minimum wage, which could have helped some 839,000 people in her state.2

“These solutions matter,” Sinema concluded. “They make an impact in the lives of everyday Americans. And this is how government should work.”

Blaming the voters for not appreciating you is not just bad politics. It’s also a means of political gaslighting: telling your constituents you’re doing things that help them, while writing bills and casting votes that do the opposite.

Sinema didn’t invent this tactic, however. It’s one that corporate America has honed for decades.

***

Earlier this year for The American Prospect, I reviewed One Day I’ll Work for Myself, a new book by UNC-Chapel Hill historian Benjamin C. Waterhouse. One of Waterhouse’s core arguments, I wrote, is that “corporate interests have used the rhetoric of protecting small businesses and entrepreneurs as a pretext for shedding their obligations to their workers and to society, and as a distraction from their efforts to protect themselves.”3

Waterhouse demonstrates that over the past half century, this elite pandering to the idea of small businesses has proven to be an extraordinarily effective cover for policies that serve large corporations and their executives. This is, presumably, why it is once again among the strategies being deployed by the country’s most powerful business trade groups, and their supporters on Capitol Hill, to push for new tax breaks that would mainly benefit big companies.4

One such tax break would allow firms to immediately deduct from their taxes more of the interest they pay on their debt. As I reported recently for The Guardian, this wonky policy has huge implications for the debt-reliant private equity industry.5 Interest deductibility is, as Axios put it, “a straw that stirs the [private equity] drink.”6

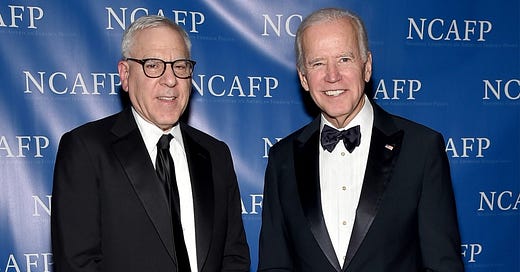

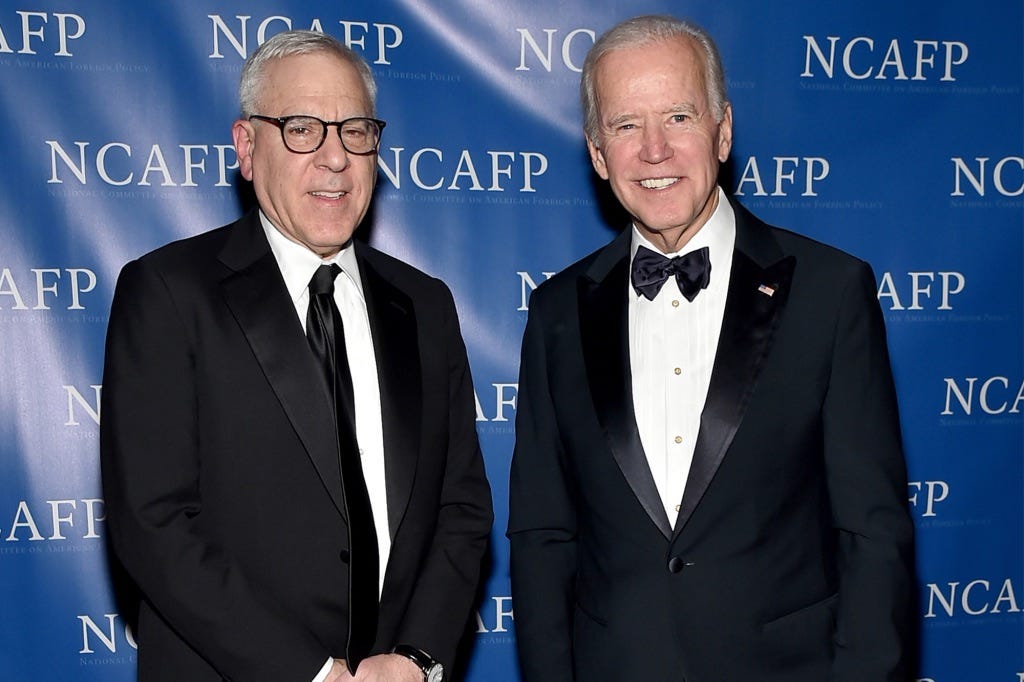

Sinema has been among Congress’s most steadfast defenders of the private equity industry, even threatening to sink President Joe Biden’s landmark climate bill unless Democrats removed a provision, known as “carried interest,” that helps private equity funds and their executives pay lower taxes than most other companies and workers.7 Then, after the law passed, Sinema successfully helped the industry escape a new “corporate minimum tax” designed to fight corporate tax dodging.8

Employees of private equity and other investment firms, meanwhile, have been similarly steadfast defenders of Kyrsten Sinema, sending her nearly $800,000 in campaign contributions since 2023—more than any other member of Congress—according to OpenSecrets.9 (What’s more, all of these donations came before anyone knew whether she would run for reelection.)

***

So perhaps it’s no surprise that Sinema became one of the lead Senate sponsors of the American Investment in Manufacturing (AIM) Act, a bill that would raise the cap on interest deductibility.10

The Arizona senator portrayed this bill as something other than a handout for private equity executives. “We’re empowering Arizona small businesses with the economic freedom to grow and thrive by cutting harmful costs in the tax code,” Sinema announced in a press release about the bill.11 The release mentioned “small businesses” eight times, noted Steve Wamhoff of the Institute on Taxation and Economic Policy (ITEP).12

Following a September briefing for Capitol Hill staff about the AIM Act, Sinema issued another statement: “In Arizona, small businesses power our economy and create opportunities for everyday Arizonans by making up over 99.5% of all our businesses. That’s why I’m laser focused on helping them thrive and build a healthy economy, so all Arizonans can build better lives for themselves and their families.”13

Language about protecting small businesses has been a central part of the messaging campaign to loosen the interest deduction cap. During a House subcommittee hearing that took place the day before the Hill briefing, one Republican argued that limiting interest deductions “unfairly penalizes small businesses” that are seeking “to grow their businesses and hire employees.”14

“Small businesses are the engines that drive America’s economy,” echoed GOP congressman Jason Smith, the chairman of the House Ways and Means Committee and champion of the tax deal in the House.15

There’s just one problem with all of this bipartisan hyperventilating about small businesses: The limit on interest deductibility—which Sinema, Smith, and a “who’s who” of corporate trade groups warn must be raised to prevent Main Street from crumbling and taking American prosperity with it—doesn’t affect small businesses.

The cap only applies to firms with annual gross receipts above an inflation-adjusted threshold, which currently sits at $29 million a year. As ITEP’s Steve Wamhoff said to me, “Who do you know who thinks that’s what a small business is?”

Based on figures I found in a report of the Joint Committee on Taxation (JCT), I calculated that among more than 38 million businesses that filed tax returns in the United States in 2019, fewer than 0.75% reported annual receipts exceeding $10 million.16 (Presumably, an even smaller number have receipts above $29 million, though the JCT report didn’t break out the numbers in that much detail.)

This overly conservative estimate suggests that more than 99% of U.S. businesses are not impacted by the interest deduction cap.

Plus, for the very small percentage of very large companies that are subject to the limit and do exceed it one year, they can simply roll over the interest that they weren’t able to deduct from one year to the next. This pattern can continue “indefinitely,” according to the nonpartisan Congressional Research Service.17

***

The American Investment Council, private equity’s main trade group, as well as some of the country’s biggest funds and their subsidiaries, spent more than $24 million lobbying the federal government last year.18

Companies don’t always specify the bills they lobby on, but disclosures compiled by OpenSecrets indicate that raising the interest deduction cap was certainly a priority, including one bill in particular: Sinema’s AIM Act (and its companion bill in the House).

During the second half of 2023, for instance, as the contours of a congressional tax deal pairing corporate tax cuts with a modest expansion of the child tax credit were emerging, the private equity giant the Carlyle Group paid Miller & Chevalier, a DC lobbying shop, $120,000 to push specifically for the AIM Act.

(Between 2019 and 2024, employees affiliated with Carlyle made up the second-largest contributor to Sinema’s campaign—nestled between two other private equity funds: her top donor, Blackstone Group, and her third-place contributor, Apollo Global Management.19)

Miller & Chevalier sent a bipartisan trio lobbyists to the Hill on Carlyle’s behalf, including a former counselor to one of President Barack Obama’s IRS commissioners and two former tax counsels for the House Ways and Means Committee, according to disclosures published by OpenSecrets.20

Language similar to the AIM Act was included in the congressional tax agreement that passed the House earlier this year.

***

Supporters of these corporate tax cuts promise incessantly that they will help not just small businesses, but American small businesses.

Not many American small businesses have subsidiaries in multiple countries. But quite a few large corporations do—and the interest deductibility provision could help some of these multinationals lower their tax bills even further by taking advantage of different countries’ tax rates.

Consider Multinational, Inc., a hypothetical company based in the United States with a subsidiary in a low-tax country like the Cayman Islands. Multinational, Inc. might choose to report its profits in the Caymans—the country has no corporate income tax—but most of its expenses in the United States, which has a higher corporate rate but also a tax code that provides generous deductions for expenses.21

Multinational, Inc. could have its subsidiary in the Cayman Islands “loan” money to its U.S. arm. That would lower its reported profits in the Caymans. And because the U.S. firm would have to pay interest on that “loan”—even though the loan came from the same company—the shift could also reduce its U.S. tax bill since it would be able to deduct some of the “expense” of that interest.

It’s impossible to say whether raising the interest deductibility threshold would lead to more profit shifting than already happens now. The provision “is likely to create some additional incentive in the case of some multinationals,” Zorka Milin, the policy director for the Financial Accountability and Corporate Transparency (FACT) Coalition, told me in an email. “We just can’t be sure how significant that effect is.”

But two things are certain. The first is that Congress’s tax deal—despite the patriotic, American-jobs-and-growth rhetoric surrounding it—won’t encourage U.S.-based multinationals to stash any less of their money in foreign tax havens.

The second certainty is that whether the tax agreement ends up with Biden’s signature or, as seems more likely right now, remains stalled in the Senate, American taxpayers are set to continue subsidizing the profit shifting of some of the country’s largest companies.22

“By standing up to short-sighted partisan ideas,” Sinema said in her retirement video, “I protected our country’s economic growth and competitiveness, and kept taxes low during a time of rampant inflation.”

On that measure, American executives could not agree more.

Thanks to Bob Lord, Sarah Christopherson, Zorka Milin, Chye-Ching Huang, Steve Wamhoff, and many other tax policy experts who helped me make sense of all of this.

https://twitter.com/SenatorSinema/status/1765094840214127068

https://www.washingtonpost.com/politics/2021/03/06/sinema-thumbs-down; https://twitter.com/GregTSargent/status/1367903888943312900?s=20; https://www.washingtonpost.com/opinions/2021/03/03/minimum-wage-hurt-red-states-brookings

https://prospect.org/culture/books/2024-02-16-stories-corporations-tell-williams-waterhouse-review

https://prospect.org/economy/2024-01-18-unequal-tax-trade; https://patrioticmillionaires.org/2024/02/09/breadcrumbs-for-the-poor-and-bread-baskets-for-corporations

https://www.theguardian.com/business/2024/mar/01/corporate-tax-breaks-private-equity; https://www.theguardian.com/us-news/2024/jan/12/corporation-tax-break-lobby

https://www.axios.com/2021/04/22/private-equity-corporate-interest-deductibility

https://www.cnbc.com/2022/08/05/sinema-made-schumer-cut-carried-interest-loophole-from-reconciliation-bill.html; https://www.cnbc.com/2022/08/09/how-wall-street-wooed-sen-kyrsten-sinema-and-preserved-its-multi-billion-dollar-carried-interest-tax-break.html

https://www.washingtonpost.com/us-policy/2022/08/07/inflation-reduction-act-sinema-private-equity

https://www.opensecrets.org/industries/indus?cycle=2024&ind=F2600; https://prospect.org/power/2023-07-20-investment-industry-donors-bankroll-sinema

https://www.congress.gov/bill/118th-congress/senate-bill/1232

https://www.sinema.senate.gov/sinema-introduces-bill-cutting-costs-arizona-small-businesses

https://itep.org/kyrsten-sinema-fights-to-protect-tax-breaks-for-private-equity

https://www.sinema.senate.gov/sinema-capito-detail-how-their-bipartisan-american-investment-in-manufacturing-act-fuels-opportunities

https://smallbusiness.house.gov/calendar/eventsingle.aspx?EventID=405674

https://jasonsmith.house.gov/newsroom/documentsingle.aspx?DocumentID=5347

https://www.jct.gov/getattachment/602c441e-c3ee-4867-a9cf-852fc8b364d1/x-10-23.pdf

https://www.everycrsreport.com/files/2020-06-01_IN11287_e4c25fe4be6b37a366c786a0749c87e594b8f0db.pdf

https://www.theguardian.com/business/2024/mar/01/corporate-tax-breaks-private-equity

https://www.opensecrets.org/members-of-congress/kyrsten-sinema/contributors?cid=N00033983&cycle=2024&type=I

https://lda.senate.gov/filings/public/filing/79222a32-3f94-4c1c-816c-21a4ff0a6d8a/print; https://lda.senate.gov/filings/public/filing/d0e7d8e3-9136-454f-afb2-1e6cf3ee98ef/print

https://itep.org/offshore-tax-havens-corporate-tax-avoidance-demonstrates-need-for-global-minimum-tax

https://www.axios.com/2024/02/16/jason-smith-senate-tax-deal-congress